If The Minimum Wage Would Grow As Fast As Wall Street Bonuses It Would Be $44 Per Hour Now

Tags: opinion

The pandemic had turned out to be a boon for the traders working in Wall Street as per some new data from the NY state comptroller’s office.

The firms based in Wall Street paid a mean bonus of $184,000 in 2019, which was a 10% increase from 2019. Thomas DiNapoli stated this in a press release on March 26th, 2021.

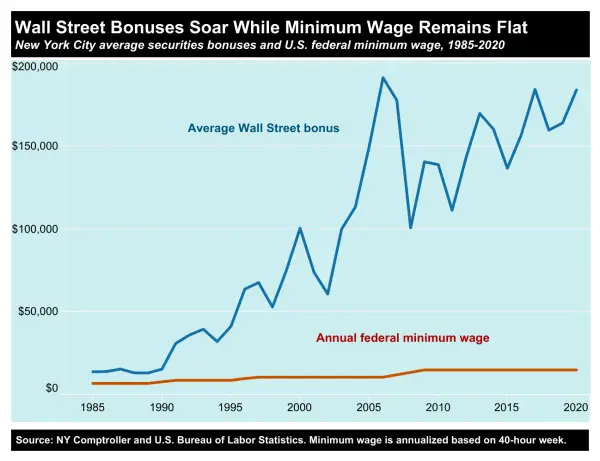

Since the 1980s, Wall Street traders have seen their bonuses grow by 1,217%. This was just a part of their overall pay, which is approximated to be more than $406,000 on an average in 2019, according to the comptroller’s office.

In comparison to this, the federal minimum wage had flattened at $7.25/ hour ($15,080 yearly) for 12 continuous years. When inflation was introduced into it, it was observed to decrease by 11% since the 1980s.

Subscribe to our Youtube channel, new videos every week:

If the growth of minimum wage was similar to the rate of growth of Wall Street bonuses, it would have reached $44.12/hour in 2021.

Wall Street Has Seen Great Highs During The Pandemic

Unlike the rest of the country, Wall Street saw great success in 2020 and experts proved their views on how this industry had detached itself from reality.

“It’s just another reminder that there’s a total disconnect between what happens on Wall Street and what happens in people’s everyday lives and in the real economy,” Sarah Anderson, the director of the global economy program at the Institute for Policy Studies, a left-leaning think tank, told Insider.

The stock market kept rising even though millions of citizens were suffering from the wrath of unemployment. The increase in volatility in the markets helped the bank executives land paydays of up to $33million, while they were laying off workers on the other hand (which they had promised not to during the pandemic).

Anderson made a blog post on March 29th, 2021, and talked about how the financial industry’s deregulation had allowed the firms to link the trader’s pay packages to massively risky investing practices that were beneficial only for Wall Street.

READ: THIS MAN LEFT WALL STREET TO START A RIDE SERVICE FOR CHEMOTHERAPY PATIENTS

“So much of what is the most rewarded on Wall Street is the kind of trading activity that really doesn’t add a lot to the real economy and isn’t essential,” Anderson told Insider, adding that last year’s huge bonuses were “mostly because of market volatility, not necessarily because they’ve added a lot of value to the economy.”

Wall Street Lobbyists Had Blocked All Efforts To Change The Pay Structure

Lawmakers had passed the Dodd-Frank Act, right after the 2008 financial crisis which banned pay packages with inappropriate risks. The people supporting Wall Street had successfully blocked those efforts to implement the rule for several years.

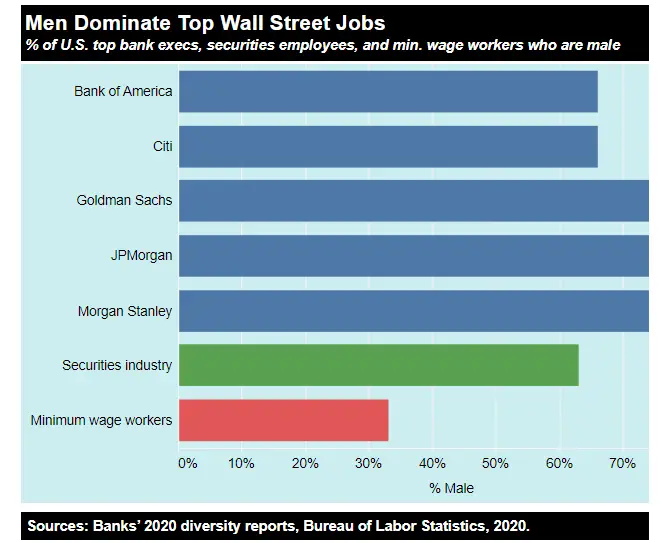

The report presented by the IPS examined how Wall Street had made gender and racial pay disparities worse by hiring white males for tens of years, disproportionately, as compared with the people of color and women overrepresented in jobs with lower wages.

Anderson wrote, “Nationally, securities industry employees are 80.5 percent white, 5.8 percent Black, 11.5 percent Asian, and 8.1 percent Latino. By contrast, whites make up an estimated 55.4 percent of people in jobs that pay less than $15 per hour.”

SUPPORT OUR WORK, JOIN US ON PATREON

WS’s lucrative but risky business models are coming under severe scrutiny as the pandemic had forced millions of Americans to recognize the US’ growing inequality.

“I just hope that it will lead to a real assessment of how skewed our values are when people doing these essential jobs are paid such a pittance compared to people on Wall Street,” Anderson told Insider.

Image credits: Public Tableau

Leave Comment: